Repo Rate Cut in September 2025: South Africans are eagerly anticipating the potential decision from the South African Reserve Bank (SARB) regarding whether they will finally cut the repo rate from the current 7.25% in September 2025. This decision is not merely a financial adjustment; it holds significant implications for consumers, businesses, and the overall economy. A reduction in the repo rate could potentially ease borrowing costs, stimulate economic activity, and provide relief to indebted households. As the date draws near, all eyes remain on SARB to see if this anticipated move will materialize.

Understanding the SARB Repo Rate Decision in 2025

The repo rate is a critical tool used by the South African Reserve Bank to manage inflation and stabilize the economy. As of now, the rate stands at 7.25%, a figure that has been maintained to curb inflationary pressures. However, with economic growth showing signs of sluggishness, there is growing speculation about a potential cut. Such a move could signal a shift in the bank’s policy towards fostering growth and addressing the challenges faced by consumers and businesses. Analysts and economists are weighing various factors, including inflation trends, unemployment rates, and global economic conditions, to predict SARB’s next steps.

- Inflation Control: The primary purpose of the repo rate is to control inflation.

- Economic Stimulus: A cut could provide a much-needed boost to the economy.

- Consumer Relief: Lower rates mean reduced loan and mortgage costs for consumers.

- Business Impact: Businesses could benefit from lower borrowing costs.

- Global Factors: International economic conditions also play a role in decision-making.

- Government Policy: The government’s fiscal stance may influence SARB’s decision.

- Interest Rates: A cut would align with global trends of lowering interest rates.

- Market Reaction: Financial markets are keenly watching SARB’s move.

Potential Impact of a Repo Rate Cut in September 2025

Should SARB decide to cut the repo rate in September 2025, the effects would be felt across various sectors. For consumers, a lower repo rate means reduced interest payments on loans and mortgages, translating to increased disposable income. This, in turn, could lead to higher consumer spending, a vital component of economic growth. Businesses would also stand to benefit as lower borrowing costs could encourage expansion and investment, potentially leading to job creation. However, the decision is not without its risks. A rate cut could potentially weaken the rand, increase foreign debt obligations, and lead to capital outflows.

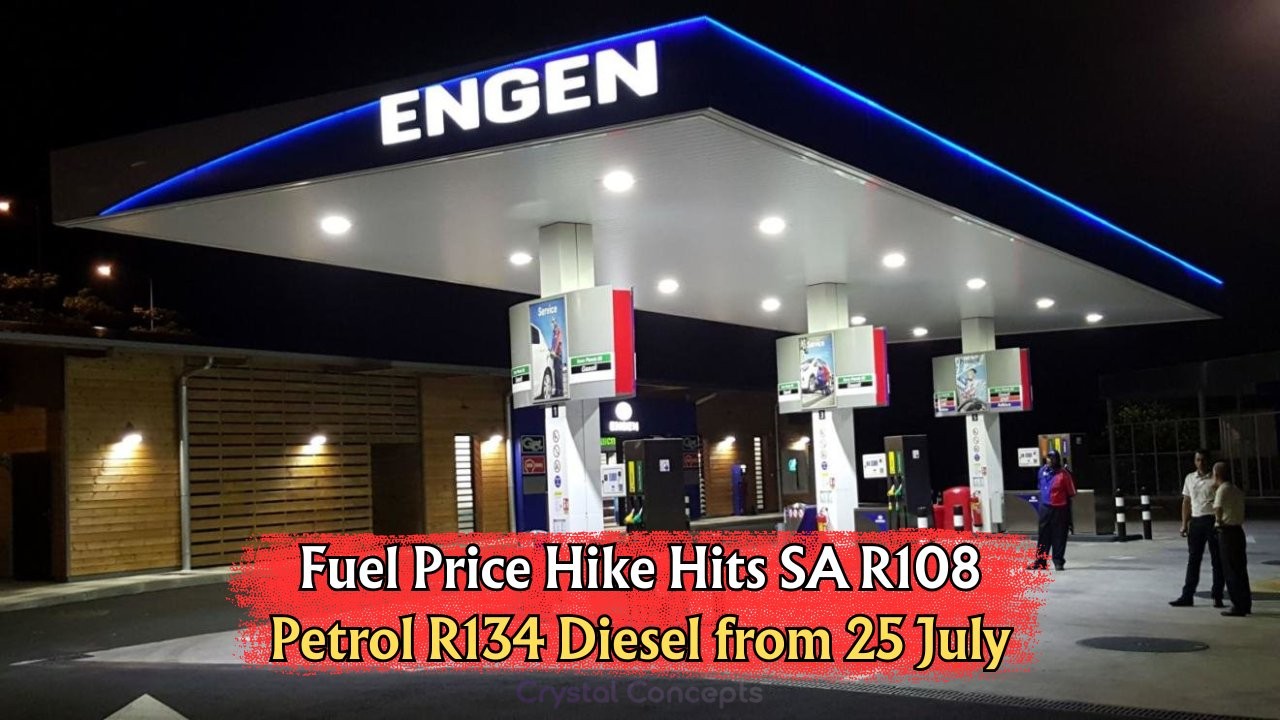

Families Brace for Impact: Fuel Prices Soar on 25 July with Diesel Rising R1.34/L and Petrol R1.08/L

Families Brace for Impact: Fuel Prices Soar on 25 July with Diesel Rising R1.34/L and Petrol R1.08/L

- Consumer Spending: More disposable income could boost retail and services sectors.

- Business Growth: Encourages investment and expansion efforts by businesses.

- Currency Risks: A weaker rand could impact import costs and inflation.

- Debt Levels: Lower rates might lead to increased consumer and business debt.

- Investor Sentiment: Could influence foreign investment and capital inflows.

Historical Context of South African Repo Rate Adjustments

Understanding past repo rate adjustments by SARB provides valuable insights into the central bank’s decision-making process. Historically, the bank has adjusted rates in response to diverse economic challenges, including inflation pressures, economic slowdowns, and global financial crises. The table below highlights key repo rate changes over the past decade, reflecting SARB’s strategic responses to dynamic economic landscapes.

| Year | Repo Rate | Reason for Change |

|---|---|---|

| 2015 | 5.75% | Inflationary pressures |

| 2017 | 6.75% | To stabilize the rand |

| 2019 | 6.50% | Economic growth concerns |

| 2020 | 4.25% | COVID-19 pandemic response |

| 2021 | 3.50% | Recovery support |

| 2023 | 7.25% | Inflation control |

| 2025 | ? | Anticipated cut |

Expert Opinions on SARB’s September 2025 Decision

Economists and financial experts are divided on whether SARB will cut the repo rate in September 2025. Some argue that reducing the rate is necessary to stimulate growth and alleviate economic pressures. They highlight the benefits of increased spending and investment against a backdrop of sluggish economic performance. Others caution against a premature cut, citing potential risks such as currency depreciation and inflationary pressures. The balancing act for SARB involves weighing domestic economic needs against potential global economic repercussions.

- Pro-Cut Argument: Supports growth and alleviates consumer burden.

- Anti-Cut Argument: Highlights risks of inflation and currency depreciation.

- Global Context: Considers international economic trends and influences.

- Domestic Needs: Focuses on local economic challenges and consumer welfare.

- Market Dynamics: Considers the potential impact on financial markets.

- Policy Balance: Weighs short-term gains against long-term stability.

Analyzing Consumer Sentiment on Potential Rate Cut

The anticipation of a repo rate cut has sparked diverse reactions among South African consumers. Many view the potential cut as a positive step towards economic recovery, offering relief from high debt burdens and encouraging spending. However, concerns remain about the broader economic implications, including inflation and currency stability. The table below provides insights into consumer sentiment regarding the potential rate cut.

| Consumer Group | Positive Impact | Negative Concerns | Neutral/Undecided |

|---|---|---|---|

| Homeowners | Reduced mortgage costs | Inflation fears | 20% |

| Small Businesses | Lower borrowing costs | Currency risks | 15% |

| Investors | Potential for growth | Market volatility | 25% |

| General Consumers | Increased disposable income | Debt accumulation | 10% |

| Economists | Stimulus for growth | Long-term stability | 30% |

FAQs About SARB’s Potential Repo Rate Cut in 2025

- What is the repo rate?

- The repo rate is the interest rate at which the central bank lends money to commercial banks.

- It influences borrowing costs for consumers and businesses.

- SARB uses it to manage inflation and stabilize the economy.

- How does a repo rate cut affect consumers?

- It reduces interest payments on loans and mortgages.

- Increases disposable income for consumers.

- Potentially boosts consumer spending and economic growth.

- Why might SARB consider a rate cut in September 2025?

- To stimulate economic growth amidst sluggish performance.

- To provide relief to indebted households and businesses.

- To align with global trends of lowering interest rates.

Relevant Questions About SARB’s Repo Rate Decision

What are the risks of a repo rate cut?

Potential risks include currency depreciation, increased inflation, and higher foreign debt obligations.

How can a rate cut influence business expansion?

Businesses may find it cheaper to borrow and invest, leading to potential expansion and job creation.

What role does global economic conditions play in SARB’s decision?

Global economic trends can influence SARB’s policy decisions, especially regarding interest rates and inflation.

How does consumer sentiment impact SARB’s decision?

Consumer confidence and spending behaviors can affect the economic outlook, influencing SARB’s rate decisions.

What are the long-term implications of a repo rate cut?

Long-term effects could include economic growth, improved consumer welfare, but also potential inflationary pressures.